The Market's Having a Midlife Crisis, and We're All Paying the Therapy Bills

So, the stock market's doing the Macarena again. Up, then down, then spinning around until you're dizzy and broke. One minute, everyone's screaming "AI to the moon!" The next, they're quietly selling off their Bitcoin and hiding under the bed. What gives?

The talking heads are saying it's a "smattering" of headlines. A smattering? Give me a break. It's more like a full-on hailstorm of bad news. Fed governors yapping about "outsized asset price declines," banks backing off those sweet, sweet December rate cuts, and even Nvidia—Nvidia!—stumbling like a drunk at a wedding.

And then there's Bitcoin. Down 2.8%? That's not just a dip; that's a faceplant into a mud puddle. "No news but certainly the moves in crypto hurt retail investor confidence," some DataTrek dude tells Barron's. Oh, certainly. As if retail investors are these delicate flowers who faint at the sight of a red candle. Let's be real, those folks are gambling addicts chasing the next high. They'll be back.

Blame Game: Who's REALLY to Blame?

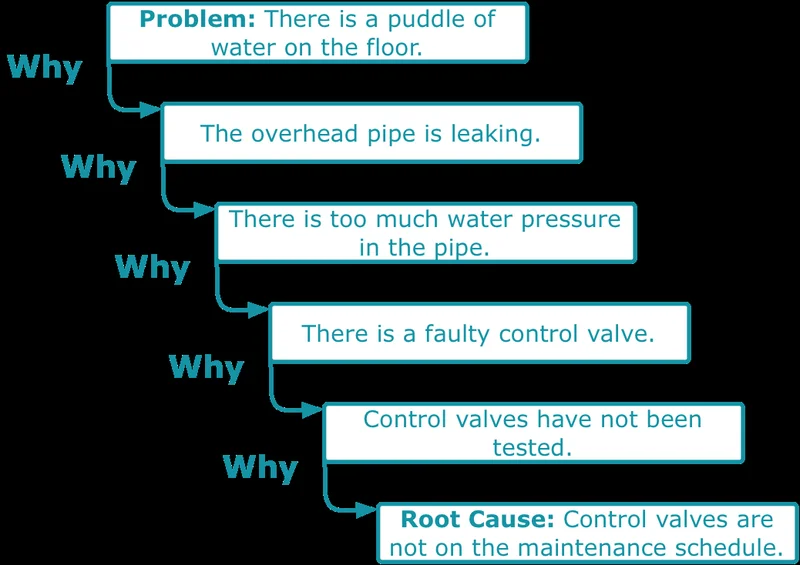

Okay, let's break this down. Everyone's pointing fingers, but no one wants to admit the real problem: the whole damn system is built on hopium and hype. We're so addicted to growth that any sign of slowing down sends the market into a panic.

And the Fed? Don't even get me started. They're like a bunch of confused doctors arguing over the right dosage of leeches. One minute they're pumping money into the economy, the next they're slamming on the brakes. No wonder everyone's jumpy.

Then there's the tech sector. Nvidia, Apple, AMD… they're all supposed to be the saviors, right? But what happens when the AI bubble finally bursts? What happens when everyone realizes that most of these "innovations" are just fancy ways to sell us more targeted ads?

The Future is...Uncertain, to Say the Least

Looking ahead, the September jobs report (delayed because our government apparently can't keep the lights on) is supposed to give the Fed some "crucial data." But here's the thing: does anyone actually trust these numbers? They're always revised, reinterpreted, and spun to fit whatever narrative the politicians are pushing.

And even if the jobs report is great, Kansas City Fed President Jeff Schmid is already warning that lower rates won't fix the "structural issues" in the labor market caused by "technological innovation and immigration policies." In other words, the robots are coming for your job, and there's not a damn thing anyone can do about it.

Offcourse, the cookie notice is also concerning...